The Surge Is GUARANTEED With The IMMINENT Revaluation Of Gold & Silver

Excellent article. Check it out.

CYA: SE:

***********************************************

by: Egon von Greyerz

CYA: SE:

***********************************************

by: Egon von Greyerz

The coming gold and silver surge is guaranteed. It is

not a question of IF but only WHEN. Initially, the imminent revaluation

of the precious metals will have nothing to do with an investment mania

but with the total mismanagement of the world economy. A spectacular

rise in the metals is just a reflection of the mess the world is in. But

as the paper market fails in gold and silver, there will be panic and

manic markets.

So has the Silver Rocket just started? Last week I

talked about the coming silver explosion and we could be seeing the

beginning of it right now. I have often talked about the Gold-Silver

Ratio as the key to the turn up in the precious metals.

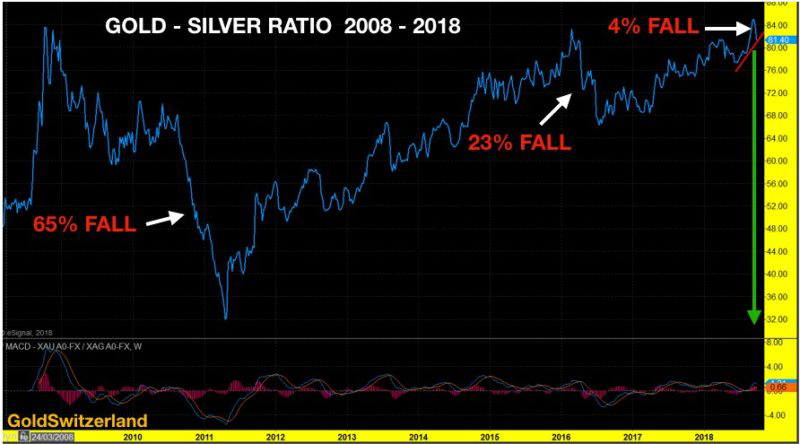

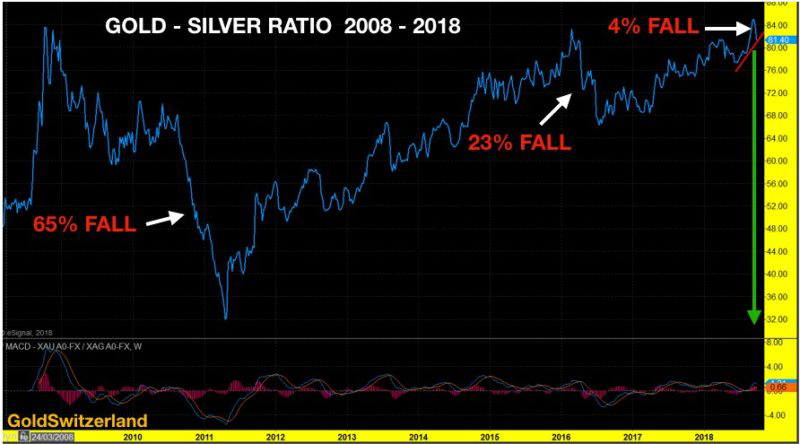

GOLD-SILVER RATIO – A LEADING INDICATOR

With bearish divergence on momentum indicators at the

critical 80-84 level, it was always a matter of time before the

Gold-Silver ratio would break down. When the ratio turns down from an

important level, it signifies a turn up in the metals with silver

leading the way. As the long term chart below shows, the target for the

ratio is 15-30. A return to the historical level of 15 would mean that

silver will move up 6x as fast as gold.

If we look at the Weekly chart of the Gold – Silver

ratio below, it shows the 4% fall that has taken place in the last 10

trading days. In itself this fall might not seem significant. But the

key is the reversal from a very important top area combined with bearish

technical indicators. As the chart shows, this ratio can fall very fast

once it starts, like the 65% fall in 2010-11 or the 23% fall in 2010.

ONLY ONE SOLUTION TO THE GLOBAL MESS

Normally I avoid talking about short term moves since

they make no difference to the long term strategic picture, especially

from a wealth preservation point of view. The fact is that the world is

in a mess economically, financially, politically and morally. We are

seeing examples of this daily in most countries around the globe.

One thing is certain, no political leader whether it is Trump, Merkel or May or the EU King Junker has a chance to solve these problems. There is only one solution to the shambles the world is in.

The excesses and moral decadence of the

magnitude the world is experiencing today can never vanish in an orderly

way. Sadly, only a total economic collapse can solve the problem. And

this is of course inevitable. No government, no corporation and no

individual can or will ever repay the $250 trillion debt that is owed.

Nor will values or decency return by themselves. For example, the world

is more interested in whether or not a Supreme Court judge candidate had

a teenage fling 36 years ago rather than having a properly functioning

legal system.

So global debt must implode together with all the assets that the debt are artificially underpinning. This debt is a pest that must be eradicated from the face of the earth.The

world needs bad times to come back to real values and morality. Only

from that level can we get back to genuine growth at all levels.

The suffering to get there is of course going to be

horrible for the world. But this is the price that we must all pay for

the untenable situation we are in.

All of this can happen very quickly or it can be a

slow and torturous process. In the meantime we must prepare to the best

of our ability and enjoy life which after all is why we are all here.

1970S – MARKET CRASH, OIL CRISIS, MINERS’ STRIKE, 21% MORTGAGE RATE

Having had a long business life, it is natural to

draw parallels with previous periods which were testing. In one sense, I

was fortunate to experience a mass of economic and political problems

early in my working life. That quickly gave me an excellent

understanding of risk and unforeseen events.

I came to the UK in the early 1970s from Switzerland.

I joined a small photographic retailer. In the early 1970s there was a

global oil crisis. In the UK there was a coalminers’ strike, and our

retail stores only had electricity 3 days a week. The other days of the

week we sold televisions with candlelights. The UK stock market

declined by over 60% between 1973 and 1974. In the US the Dow was down

by 47%. I received my first options in the company at £1.32. 18 months

later they were 9 pence. The interest on my mortgage went up to 21%. But

the UK survived and so did our company that we later built up to the

UK’s largest consumer electronic retailer and a FTSE 100 corporation.

They were certainly testing times, filled with what seemed

insurmountable obstacles. What is coming next will be many times worse.

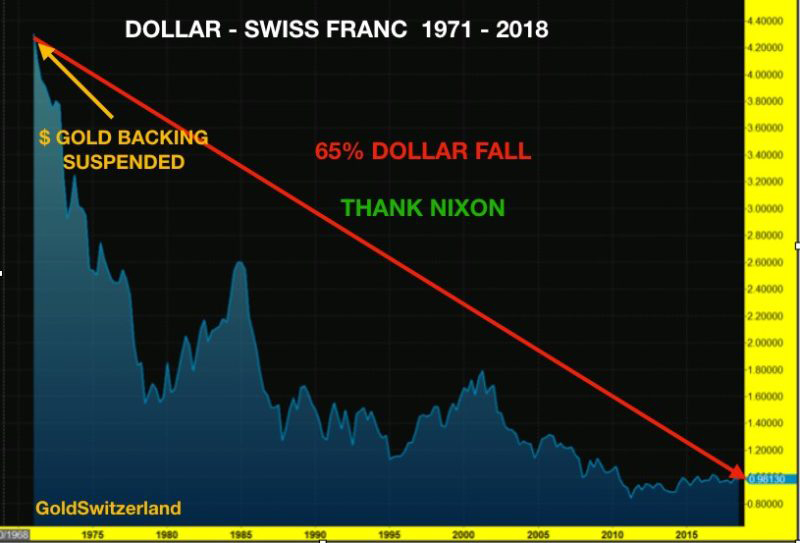

NIXON THREW THE DOLLAR TO THE WOLVES

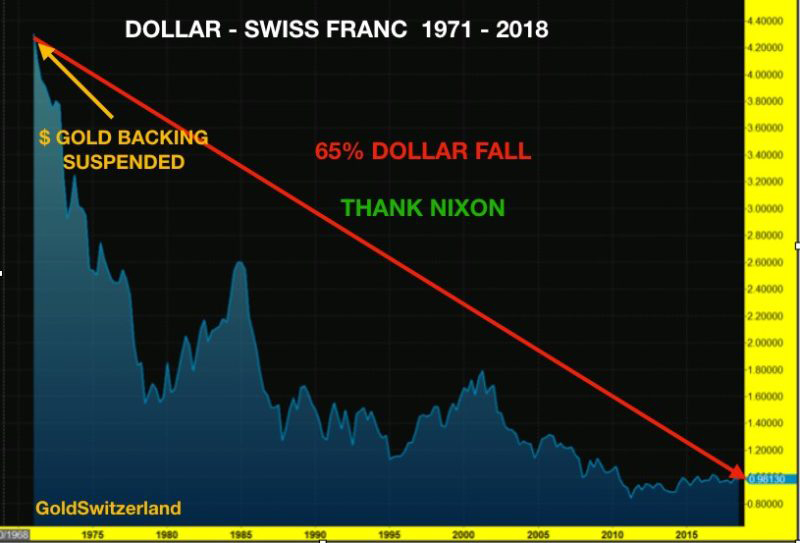

During this period, in August 1971, Nixon threw the

dollar to the wolves by abandoning the gold backing of the greenback.

That led to the dollar losing 96% against gold between 1970 and

1980. The dollar also lost massively against many currencies. Against

the Swiss franc for example the dollar lost 65% between 1971 and 1979.

Looking at the Dollar Swiss franc chart above, the

price target is around 45 Swiss cents to $1 – a 46% devaluation from

here. What is certain is that the dollar is in a clear downtrend and has

a long way to go on the downside. But no one must believe that the

Swiss franc will be strong. This is a relative game and the Swissy will

just fare a bit better than the dollar in all the currencies’ race to

the bottom.

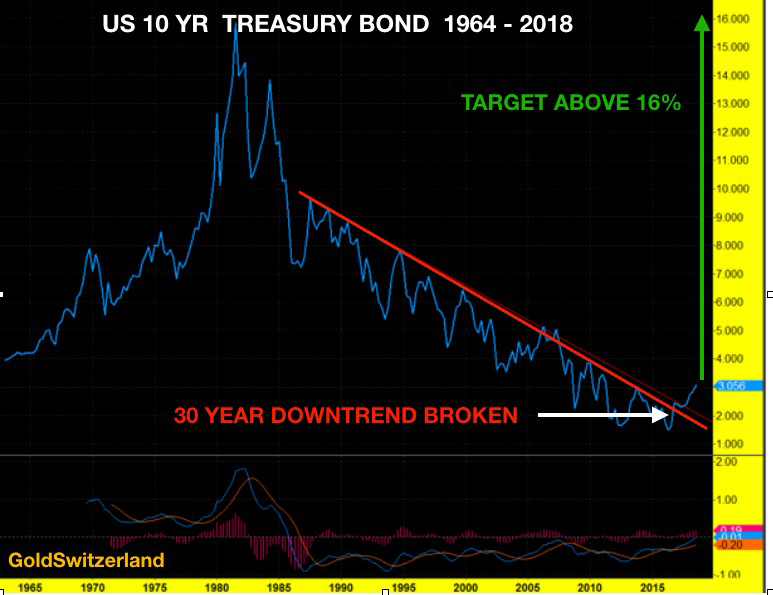

US RATES HAVE BROKEN 30 YEAR DOWNTREND

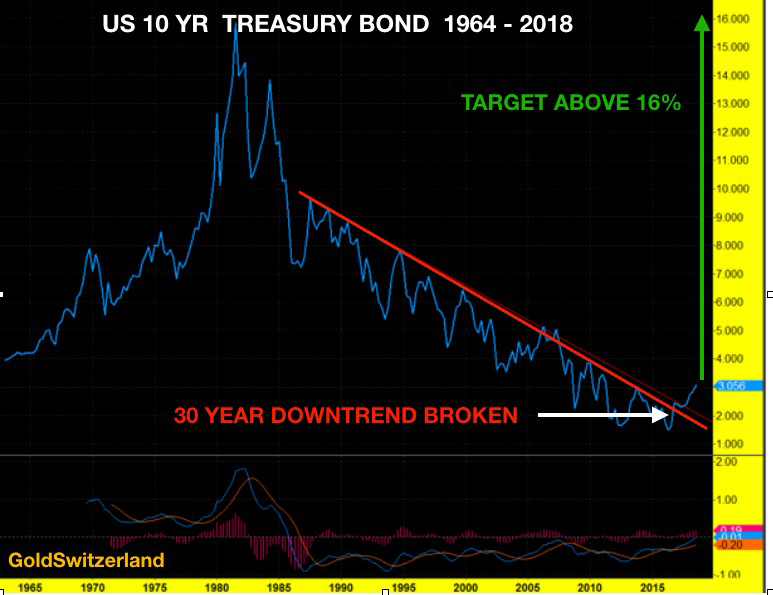

The reason that I try to paint a picture of the 1970s

economic woes is that there are many similarities with today. The

interest rate cycle had already bottomed in 1945 and was in an uptrend.

The US 10 year Treasury was around 6% in 1971. As the chart below shows,

the rate peaked in 1981 at 16%. The 35 year cycle bottomed right on

time in 2016 at 1.3%.

More significantly, 10 year Treasury rates have not

just bottomed but also broken out of a 30 year downtrend. It would be

surprising to see this rate staying below the 1981 16% peak. With

hyperinflation, rates could reach infinity as US debt becomes worthless.

Comments

Post a Comment