Silver Price Forecast 2017/2018: Silver Prices Likely To Rise In A Concentrated Manner

Friends. This is a short, but very positive article. Check it out.

CYA: SE:

**************************************************************

Previously, these significant points, like a stock market peak, a bottom in interest rate and monetary collapse occurred in a much more scattered manner. For example, the big stock market crash of the Great Depression occurred in 1929, monetary system collapse or change occurred in 1933/1934 (dollar/gold revaluation), while the interest rates bottomed around 1941.

It was after the last of these events, the bottom in interest rates (or the peak in government bonds) in 1941, that silver prices really took off and kept on rising for many years.

Currently, with the more concentrated occurrence of these events possible, we are likely to see a more explosive rise in the price of silver, once all of these events have occurred.

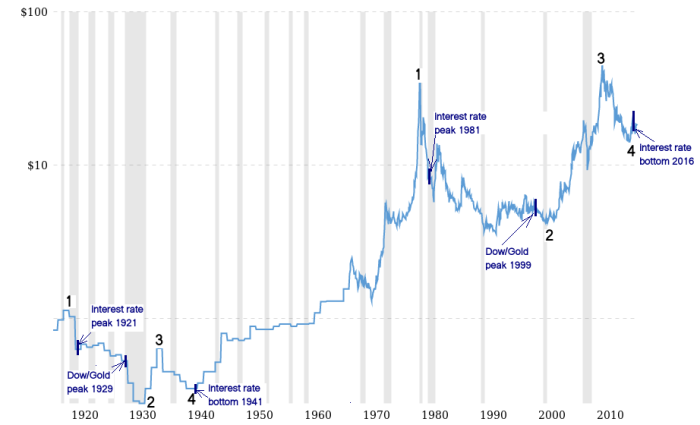

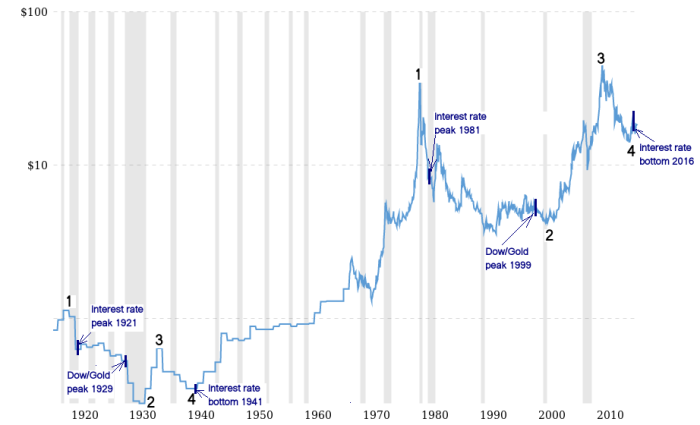

Below, is long-term chart of silver (chart from macrotrends.net), which shows the bullish outlook:

On the chart, I have marked two fractals (1 to 4), to show how the period from 1921 to 1941 is similar to 1980 to 2016, for the silver market. The two fractals exist in similar conditions relative to interest rate peaks and bottoms, as well the Dow/Gold ratio peaks.

However, as explained above, it is likely that we could end up having a more concentrated occurrence of events that are silver price positive, if the stock market peak this year (which might have happened already), and we also have a major US dollar collapse this year or next year.

On the chart, we appear to be around point 4, the point where silver prices and interest rates are likely to rise significantly. Extreme monetary distress and a stock market collapse will add the explosive effect, causing silver to rise much higher and faster than it did from 1941 to 1980.

CYA: SE:

**************************************************************

Silver Price Forecast 2017 / 2018 Silver Prices Likely To Rise In A Concentrated Manner

The long-term view of silver is extremely bullish, given that it is one of the most undervalued metals, today. It is evident that ideal economic conditions are present, for silver prices to rise for many years to come:- All-time low interest rates, that are about to rise

- Over-valued stock markets

- Fragile international monetary system that is debt-laden to the full.

Previously, these significant points, like a stock market peak, a bottom in interest rate and monetary collapse occurred in a much more scattered manner. For example, the big stock market crash of the Great Depression occurred in 1929, monetary system collapse or change occurred in 1933/1934 (dollar/gold revaluation), while the interest rates bottomed around 1941.

It was after the last of these events, the bottom in interest rates (or the peak in government bonds) in 1941, that silver prices really took off and kept on rising for many years.

Currently, with the more concentrated occurrence of these events possible, we are likely to see a more explosive rise in the price of silver, once all of these events have occurred.

Below, is long-term chart of silver (chart from macrotrends.net), which shows the bullish outlook:

On the chart, I have marked two fractals (1 to 4), to show how the period from 1921 to 1941 is similar to 1980 to 2016, for the silver market. The two fractals exist in similar conditions relative to interest rate peaks and bottoms, as well the Dow/Gold ratio peaks.

However, as explained above, it is likely that we could end up having a more concentrated occurrence of events that are silver price positive, if the stock market peak this year (which might have happened already), and we also have a major US dollar collapse this year or next year.

On the chart, we appear to be around point 4, the point where silver prices and interest rates are likely to rise significantly. Extreme monetary distress and a stock market collapse will add the explosive effect, causing silver to rise much higher and faster than it did from 1941 to 1980.

Comments

Post a Comment